Aaj ke is topic me baatane wala hu ki GST Registration Kaise Kare aur GST Number Kaise Le. lekin is topic ko shuru karne se pahle GST ke baare me thori si jankari le lete hai.

GST jiska pura naam Goods and services Tax hai. kya aap jante hai ki GST ab humare Bharat desh me bhi laagu ho chuki hai yani ab jo bhi Vaastu aur Sewaye hai unpar TAX vasula jayega. Yah tax 3 prakar ke category me devide kar diya gaya hai. jo ki GST ka hi hissa hai. aaye jante hai wo 3 category kon se hai.

GST jiska pura naam Goods and services Tax hai. kya aap jante hai ki GST ab humare Bharat desh me bhi laagu ho chuki hai yani ab jo bhi Vaastu aur Sewaye hai unpar TAX vasula jayega. Yah tax 3 prakar ke category me devide kar diya gaya hai. jo ki GST ka hi hissa hai. aaye jante hai wo 3 category kon se hai.

- Pahle sthan par hai CGST (Central Goods And Service Tax ) jo ki Central Goverment dwara vasuli jayegi.

- Dusra SGST(State Goods And Service Tax) yaani State GST aamtaur par yah State ke andar hone wale karobar par vasuli jayegi. udaharan se samjhte hai, yadi koi jharkhand ka vyakti jharkhand ke andar hi kisi vyakti ko maal bechta hai to us vaastu par lagaane wali GST rate 18% hai. to 9% CGST aur 9% SGST lagaya jayega. jo ki Central Govt. aur State Govt. ko barabar hisso me baat diya jayega.

- Teesre number par hoga IGST(Integrated Goods and Service Tax) yaadi koi karobaar do state ke bich hoti hai. maan lijiye ki yadi koi vyakti apne state se dusre state me apne maal ko bechta hai. to unpar IGST dwara tax vasula jayega. jinpar 18% GST rate lagaya jayega. aur yah do barabar hisso me Central govt. aur State govt. ko bhej diya jayega.

GST Registration Kaise Kare

New GST Registration Kaise Kare Online, GST India me 01 July 2017 ko Suruwat Ki Gayi Thi. GST [The Goods and Services Tax] Yah Ek Aisi Tax System Hai Jahan Par Single Tax Goods And Services Ki Supply Par Lagaya Jata

Hai.

Yaadi Aap GST me Registration lena chahte hai to Ye Website Step-by-Step Apki Puri Help Karegi. aap es post ko pura Read kare aapko es post se puri Jankari milegi. online GST Registration Kaise Karte Hai Aap is Post Ke Help Se GST Number le Payenge. Niche diye gaye steps ko dhyan se follow kare.

GST kisko lena hai ?

GST ke liye kise Registration karna chahiye? ya GST Number kise lena chahiye? ise dhyan se padhe.

Click here..gst.gov.in registration

- Agar Apka Business 20 Lakhs se upar hai to Apko GST Number lena Mandatory hai (North-Eastern States, J & K, Himachal Pradesh aur Uttrakhand ke liye 10 Lakhs se upar)

- E-commerce business ke liye (Amazon, Flipkart, Snapdeal, Ebey, etc.)

- Casual Taxable Person/None-Resident Taxable Person.

- Agents of a suppliers & Input service distributor.

- Those paying tax under the reverse charge mechanism.

- Person who supplies via e-commerce aggregator.

- Person supplying online information and database access or retrieval services from a place outside india to a person in india, other than a registered taxable person.

- Etc.

GST number ke liye document

- PAN of the Applicant the Place of Business

- Aadhaar Card

- Photograph (max size 2 MB)

- Signature (max size 2 MB )

- Address Proof of (Lease Agreement/Property Tax Receipt/Electricity Bill/Rented Agreement)

- Bank Account Statement/Cancelled Cheque/Passbook

GST Registration Procedure in Hindi

Step by Step Guide, Read Carefully.

Normal Taxpayer GST Registration khud se karne ke liye diye gaye Step ko follow kare.Internet Browser Open kare or GST Official website par jaye.

Normal Taxpayer GST Registration khud se karne ke liye diye gaye Step ko follow kare.Internet Browser Open kare or GST Official website par jaye.

Click here..gst.gov.in registration

NOTE : GST Registration ko 2 part me divide kiya gaya hai Part A or Part B.

GST Registration Part A

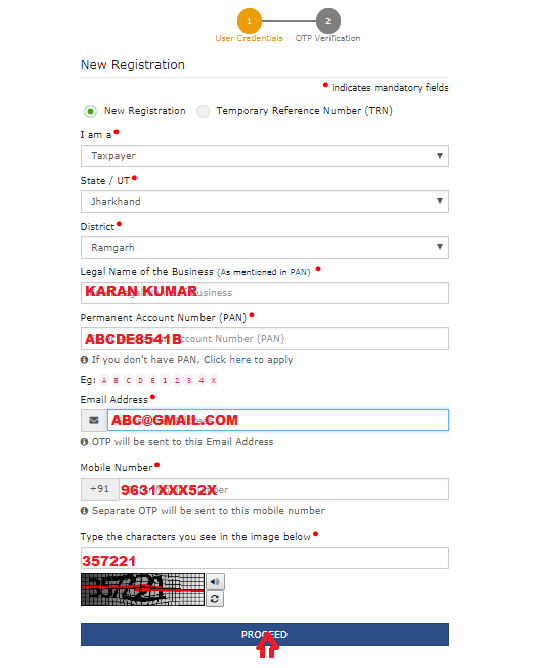

Services ⏩ Registration ⏩ New Registration Button click kare.

⏩ I m a drop down list me Taxpayer select kare.

⏩ aap jis State ke liye GST Apply kar rahe hai, State select kare.

⏩ Apna Dist select kare.

⏩ Agar aap Proprietor hai to Legal Name of the Business me apna Name Type kare jo apka PAN Name mention hai.

⏩ Permanent Account Number [PAN] me apna PAN Number Type kare.

⏩ Email Address column me apna email address Type kare.

⏩ Mobile No column me apna mobile no. Type kare.

⏩ Image me diye gaye Captcha text type kare.

Apki Diye Gaye Saari Information sahi hai to PROCEED button click kare.

⏩ aap jis State ke liye GST Apply kar rahe hai, State select kare.

⏩ Apna Dist select kare.

⏩ Agar aap Proprietor hai to Legal Name of the Business me apna Name Type kare jo apka PAN Name mention hai.

⏩ Permanent Account Number [PAN] me apna PAN Number Type kare.

⏩ Email Address column me apna email address Type kare.

⏩ Mobile No column me apna mobile no. Type kare.

⏩ Image me diye gaye Captcha text type kare.

Apki Diye Gaye Saari Information sahi hai to PROCEED button click kare.

NOTE : Yadi Aap Application Part A Puri tarah Complete kar lete hai uske baad apko Application Part A me kisi v prakar ka Edit option nhi diya jayega.dhyan rahe ki aap Application Part A me jo bhi information bhar rahe hai wo sahi ho. phir ise aap kabhi bhi change nahi kar payenge.

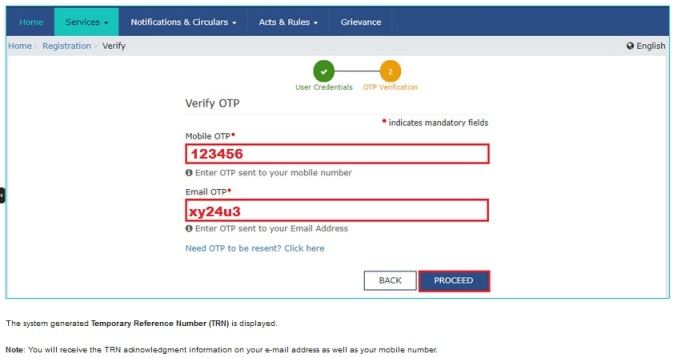

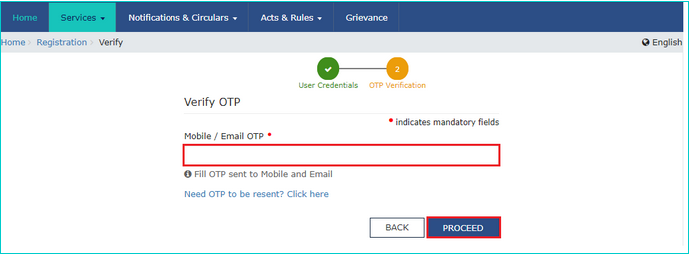

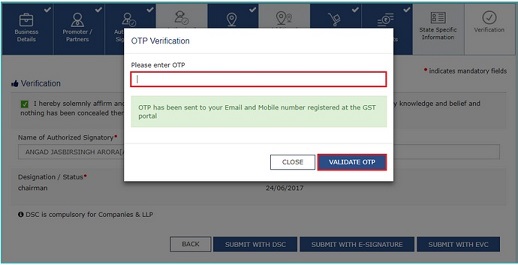

OTP Verification Page Displayed

Apke Diye Gaye Mobile Number or Email address par 2 Alag-Alag Separate OTP diya jayega, Aap dono OTP ko Separate Type kare or Proceed button click kare.

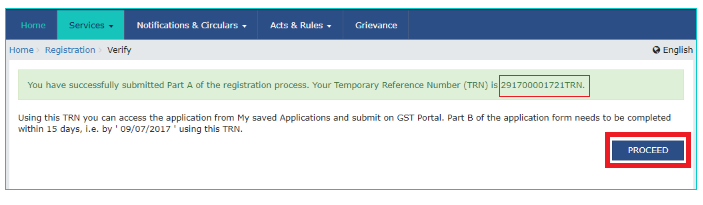

Proceed karne ke baad apke Mobile or Email par ek Temporary Reference Number TRN diya jayega use aap paper par note kar le.

Next Proceed Button click kare.

Proceed karne ke baad apke Mobile or Email par ek Temporary Reference Number TRN diya jayega use aap paper par note kar le.

Next Proceed Button click kare.

NOTE : Temporary Reference Number (TRN) milne ke baad Apko 15 days ke undar Part B Application Complete karke Submit karna hai, nahi to 15 days ke baad apka TRN automatically cancel ho jayega.

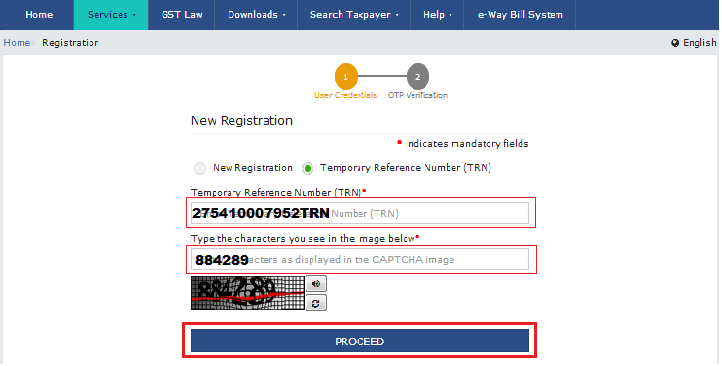

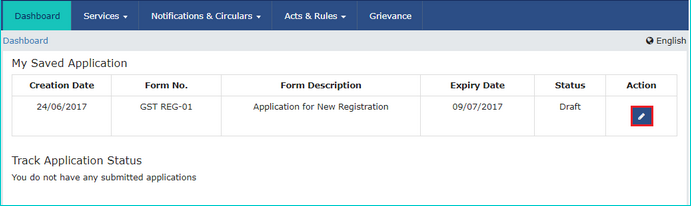

GST Registration Part B

Services ⏩ Registration ⏩ New Registration ⏩ Select Temporary Reference Number (TRN)

⏩ Temporary Reference Number (TRN) Type kare.

⏩ Captcha text Type kare.

Next Proceed Button click kare.

Apke diye gaye Mobile/Email Address par ek Same OTP diya jayega.

⏩ Captcha text Type kare.

Next Proceed Button click kare.

Apke diye gaye Mobile/Email Address par ek Same OTP diya jayega.

OTP Type kare or Proceed Button click kare.

Action-Edit Button click kare.

Apka Application Part B Open ho jayega ab One-by-One Click karke, apna Detail Fill kare.

Apka Application Part B Open ho jayega ab One-by-One Click karke, apna Detail Fill kare.

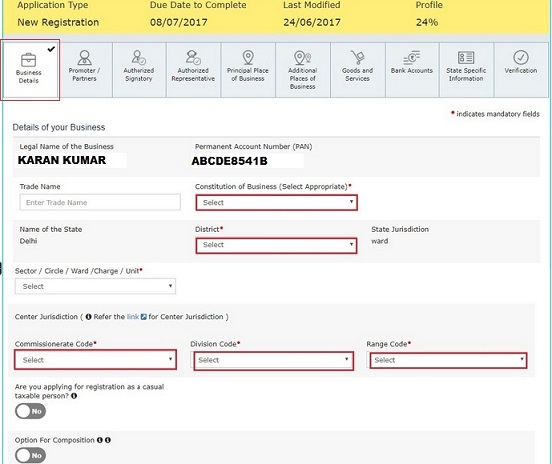

Business Detail

⏩ Agar aap kisi Name se Trade kar rahe hai to Trade Name fill kare nahi to blank rahne de.

⏩ Constitution of Business apka kya hai drop down list me select kare.

⏩ District me apna dist select kare.

⏩ Secter/Circle/Ward/Charge/Units drop down list me select kare or fill kare.

⏩ Center jurisdiction Commissionerate code/Division code/Range code select kare, samjhne ke liye Center Jurisdiction link par click kare.

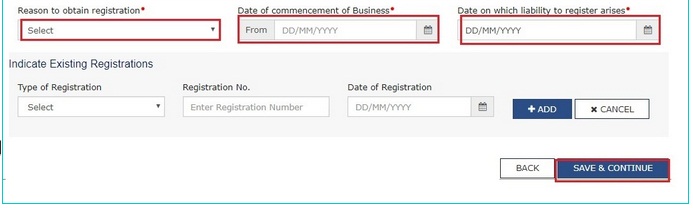

⏩ Reason to obtain registration drop down list me select kare.

⏩ Date of commencement of Business/Date on which to register arises Date select kare.

Next Save & Continue Button click kare.

⏩ Constitution of Business apka kya hai drop down list me select kare.

⏩ District me apna dist select kare.

⏩ Secter/Circle/Ward/Charge/Units drop down list me select kare or fill kare.

⏩ Center jurisdiction Commissionerate code/Division code/Range code select kare, samjhne ke liye Center Jurisdiction link par click kare.

⏩ Reason to obtain registration drop down list me select kare.

⏩ Date of commencement of Business/Date on which to register arises Date select kare.

Next Save & Continue Button click kare.

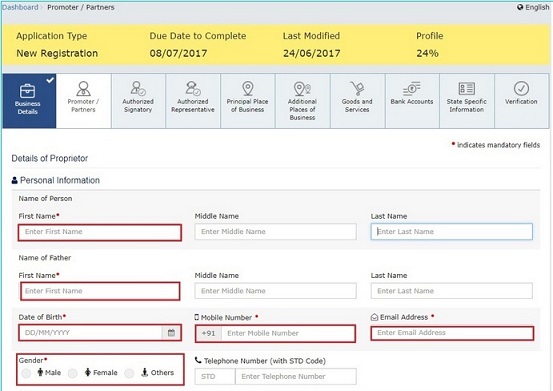

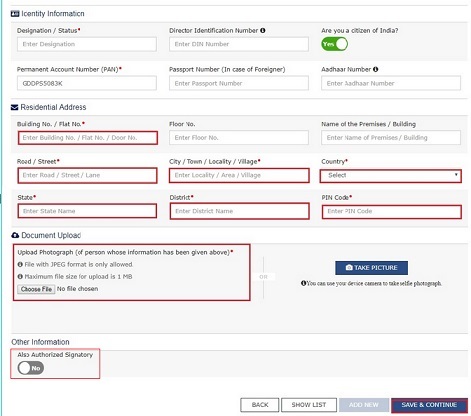

Promoter/Partners

⏩ Personal Information fill kare.

⏩ Residential Address fill kare.

⏩ Document Upload me Choose file select kare aur apna scan kiya photograph upload kare.

⏩ Agar aap ne proprietor select kiya hai to Also Authorized signatory Yes select kare.

Next Save & Continue Button click kare.

⏩ Residential Address fill kare.

⏩ Document Upload me Choose file select kare aur apna scan kiya photograph upload kare.

⏩ Agar aap ne proprietor select kiya hai to Also Authorized signatory Yes select kare.

Next Save & Continue Button click kare.

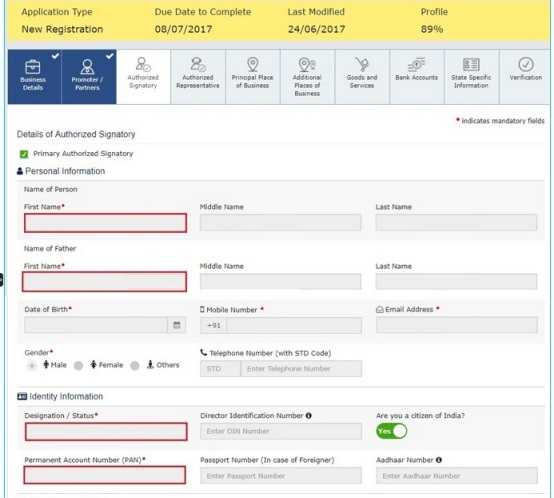

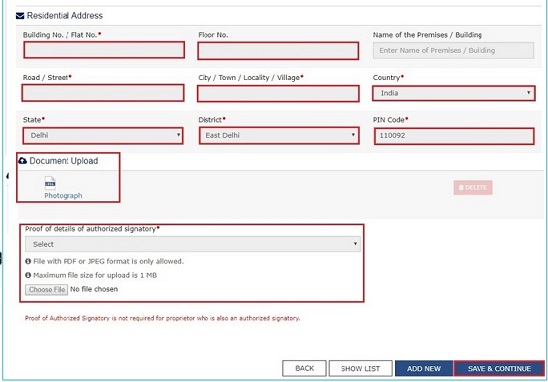

Authorized Signatory

⏩ Primary Authorized Signatory checkbox select kare.

⏩ Personal Information Detail fill kare, (e.i name, date of birth, mobile number, email address and gander.)

⏩ Identity Information.

⏩ Designation/Status Fill kare.

⏩ Personal Information Detail fill kare, (e.i name, date of birth, mobile number, email address and gander.)

⏩ Identity Information.

⏩ Designation/Status Fill kare.

NOTE : DIN Number mandatory hai agar aap.

- Private Limited Company

- Public Limited Company

- Public Sector Undertaking

- Unlimited Company

- Foreign Company register in india ke liye GST number Apply kar rahe.

⏩ Are you citizen of India 'Yes' select kare agar aap indian citizen hai, nhi to 'NO' select kare agar aap 'NO' select karte hai to apko Passport Number fill karna hoga.

⏩ Permanent Account Number(PAN) fill kare.

⏩ Aadhaar Number fill kare.

⏩ Residential Address me apna detail fill kare.

Next Save & Continue Button click kare.

⏩ Permanent Account Number(PAN) fill kare.

⏩ Aadhaar Number fill kare.

⏩ Residential Address me apna detail fill kare.

Next Save & Continue Button click kare.

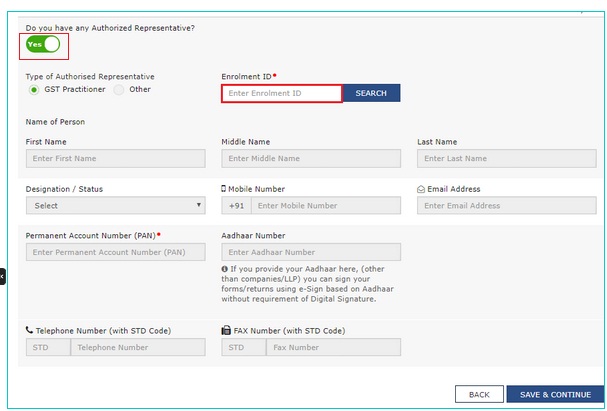

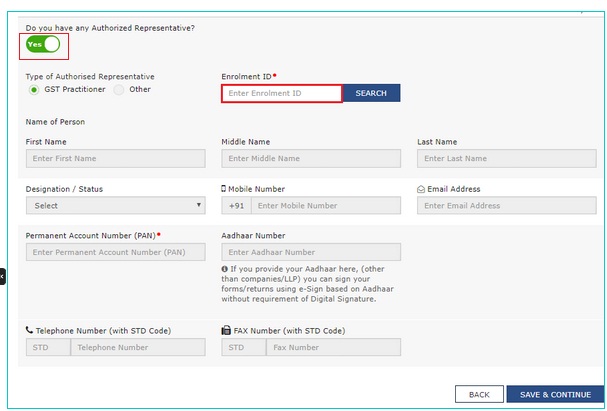

Authorized Representative

Do you have any Authorized Representative ?

yadi aap GST Practitioner hai ya Other Representative hai to 'Yes' select kare aur detail fill kare, yadi nhi to ise default 'No' rahne de.

Next Save & Continue Button click kare.

yadi aap GST Practitioner hai ya Other Representative hai to 'Yes' select kare aur detail fill kare, yadi nhi to ise default 'No' rahne de.

Next Save & Continue Button click kare.

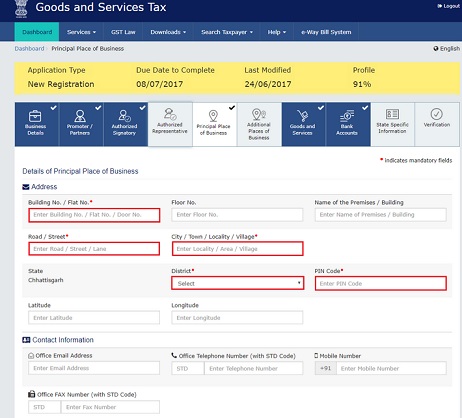

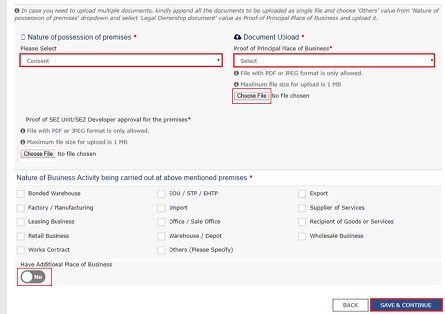

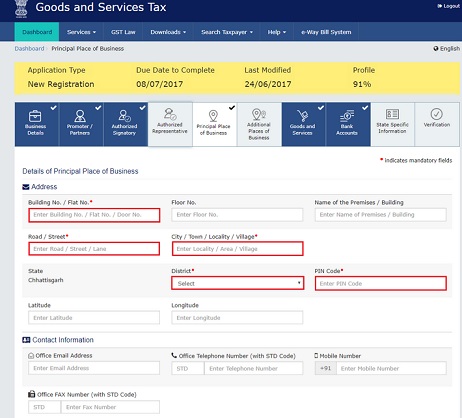

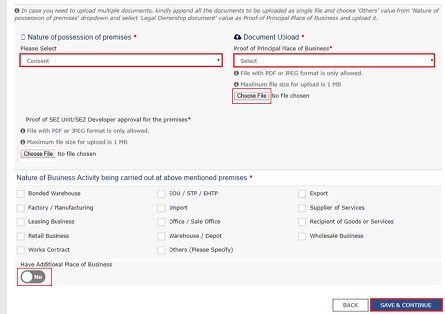

Principle Place of Business

⏩ Address fill kare (e.g. Building No/Flat No, Road/street, City/Town.Locality/Village,District, Pin Code.)

⏩ Nature of Possession of Premises drop down list me select kare.

⏩ Document Upload jo document aap upload karna chahte hai, Proof of Principle Place of Business drop down list me select kare Choose file button click kare document select kare or upload kare.

⏩ Have Additional place of business agar apke pas ek se adhik business address hai to 'Yes' select kare aur address fill kare. yadi nhi hai to ise default 'No' rahne de.

Next Save & Continue Button click kare.

⏩ Nature of Possession of Premises drop down list me select kare.

⏩ Document Upload jo document aap upload karna chahte hai, Proof of Principle Place of Business drop down list me select kare Choose file button click kare document select kare or upload kare.

⏩ Have Additional place of business agar apke pas ek se adhik business address hai to 'Yes' select kare aur address fill kare. yadi nhi hai to ise default 'No' rahne de.

Next Save & Continue Button click kare.

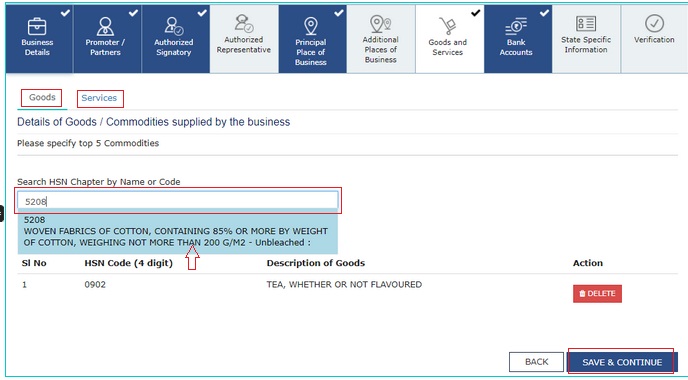

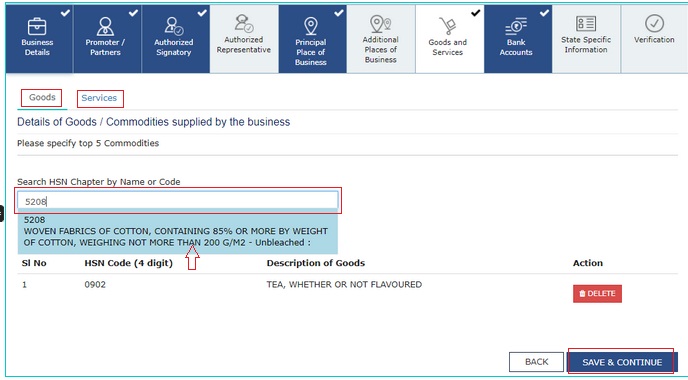

Goods & Services

Goods & Services

Aap jo Business kar rahe hai ya karna chahte hai us business ko search box me aap by name ya code se search kare aur select kare, agar apka business Goods me aata hai to Goods me search kare or yadi Service Class me aata hai to Service me search kare, Aap maximum 5 Goods or 5 Services Add kar sakte hai.

Next Save & Continue Button click kare.

Aap jo Business kar rahe hai ya karna chahte hai us business ko search box me aap by name ya code se search kare aur select kare, agar apka business Goods me aata hai to Goods me search kare or yadi Service Class me aata hai to Service me search kare, Aap maximum 5 Goods or 5 Services Add kar sakte hai.

Next Save & Continue Button click kare.

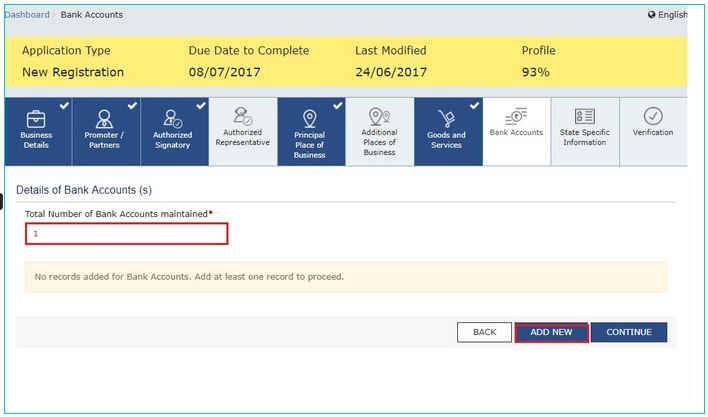

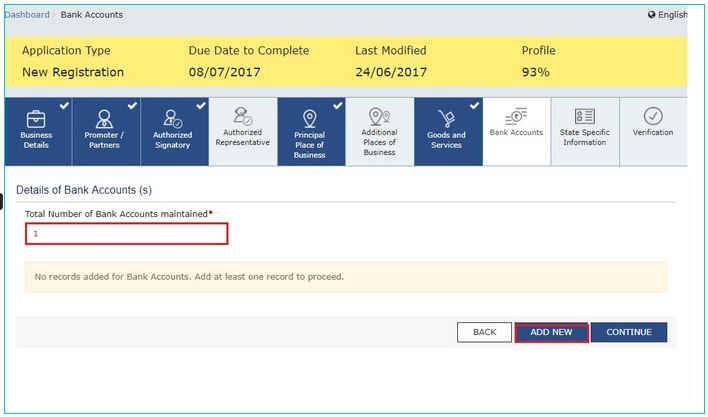

Bank Accounts

Detail of Bank Account at least 1 account detail fill karna mandatory hai

aap 1 se jyada account detail bhi Add kar sakte hai.

Total Number of Bank Account aap jitna account Add karna chahte hai number type kare phir

Add New Button click kare.

NOTE : Aap 10 Bank Account Detail Add kar sakte hai(max.)

Total Number of Bank Account aap jitna account Add karna chahte hai number type kare phir

Add New Button click kare.

NOTE : Aap 10 Bank Account Detail Add kar sakte hai(max.)

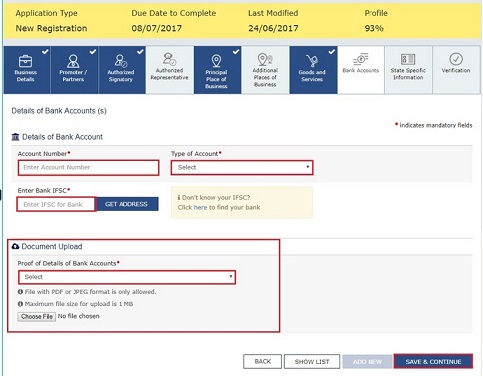

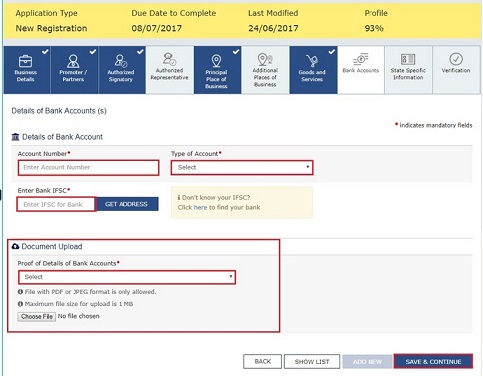

Detail of Bank Account

⏩ Account Number Fill kare.

⏩ Type of Account drop down list me apna account type select kare.

⏩ Enter Bank IFSC Code type kare phir Get Address button click kare.

⏩ Document Upload 'Proof of Detail of Bank Account' drop down list me select kare e.g Passbook/Statement.

⏩ Choose file button click kare or document select kar ke Upload kare.

Next Save & Continue Button click kare.

⏩ Type of Account drop down list me apna account type select kare.

⏩ Enter Bank IFSC Code type kare phir Get Address button click kare.

⏩ Document Upload 'Proof of Detail of Bank Account' drop down list me select kare e.g Passbook/Statement.

⏩ Choose file button click kare or document select kar ke Upload kare.

Next Save & Continue Button click kare.

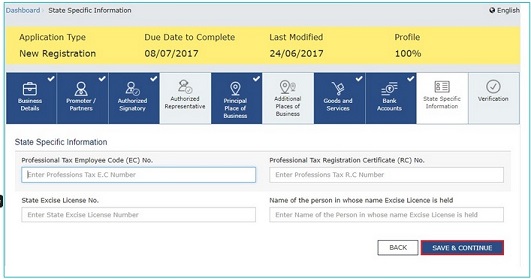

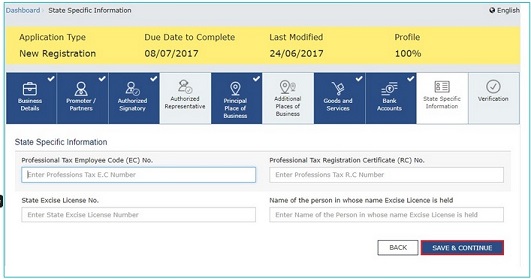

State Specific Information

State Specific Information Agar apke pas stete specific information hai to fill kare, nhi to

Save & Continue button click kare.

NOTE : Jab Aap Puri Detail fill kar denge tab apka Application 100% Show hoga. tab aap Verification kar sakte hai.

NOTE : Jab Aap Puri Detail fill kar denge tab apka Application 100% Show hoga. tab aap Verification kar sakte hai.

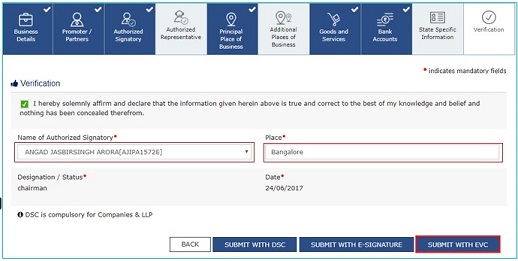

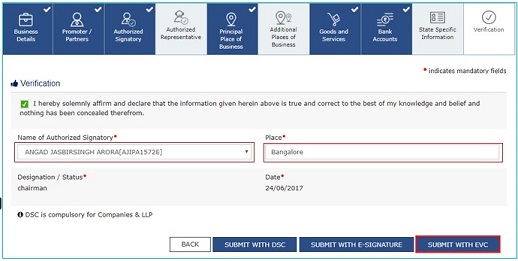

Verification

Submit With EVC

⏩ Name of Authorized Signatory drop down list me apna Name select kare.

⏩ Place fill kare.

Next Submit With EVC Button click kare.

⏩ Place fill kare.

Next Submit With EVC Button click kare.

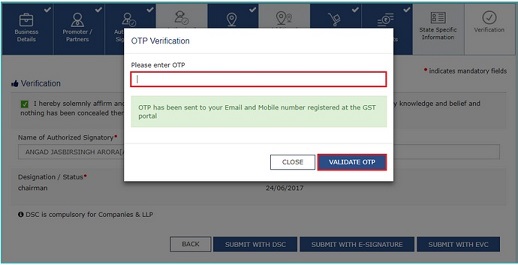

OTP Verification

⏩ Apke diye gaye Mobile Number & Email Address par OTP diya jayega us OTP ko type kare.

Next Validate OTP button click kare.

Next Validate OTP button click kare.

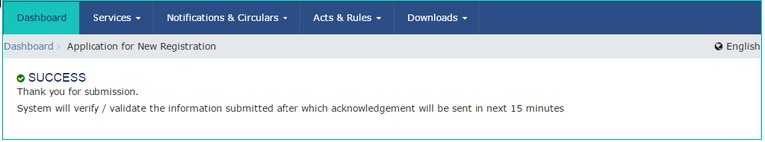

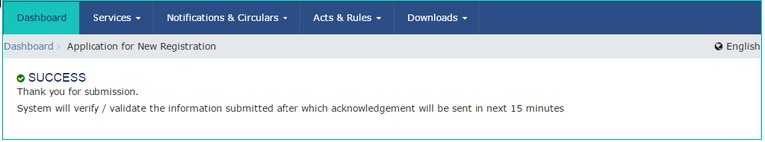

Apko 15 minute ke bad apke Email Address or Mobile Number par Acknowledgement diya jayega jisme apka Application Reference Number (ARN) rahega.

Aap ARN se apna GST Registration status check kar sakte hai.

GST Status Check kare. click here..Check Registration Status

Apki di gayi sari Information or Document sahi hai to apko 3 Working Days me GST Number de diya jayega.

Yadi GST Registration Kaise Kare se koi confusion hai ya apko Application fill karne me kisi tarah ka Problem aati hai to Mujhe Comment box me likhe. mujhe apki problem solve karne me khushi hogi.

Was this article helpful ? "If Yes Don't forget to Like & Share.

Aap ARN se apna GST Registration status check kar sakte hai.

GST Status Check kare. click here..Check Registration Status

Apki di gayi sari Information or Document sahi hai to apko 3 Working Days me GST Number de diya jayega.

Yadi GST Registration Kaise Kare se koi confusion hai ya apko Application fill karne me kisi tarah ka Problem aati hai to Mujhe Comment box me likhe. mujhe apki problem solve karne me khushi hogi.

Was this article helpful ? "If Yes Don't forget to Like & Share.

Pancard pe jo naam he wo dal raha hu to accet nahi kar raha he

ReplyDeleteSorry for my late reply my dear.....aap detail me bataye...PAN name part A ya part b me dal rahe?

DeleteDomain purchase karne ke liye gstn number chaiye kya bnana jaruri hai kya gstn number bnana

ReplyDeleteDomain lene ke liye apko GST number ki jarurat nhi hai, Domain purchase karte samay Billing me GST number de sakte hai yadi apke paas ho to, ye optional hota hai.

DeleteGst registration fees kitni hogi sir

ReplyDeleteGST Registration FREE hota hai. aap khud se online apply kar GST number le sakte hai, aur iski koi Charges nhi hoti.

DeleteMera Online business hai to mujhe kya GST registration lena hoga

ReplyDeleteGST Registration kise lena hai Is Article me Mention kiya gya hai aap puri post ko read karen.

DeleteGreat post, please keep on sharing amazing article like this! It makes me happy reading your post. dubai islamic bank car finance | credit card

ReplyDeletenice blog sir about gst registration online

ReplyDeleteThanks

Effizent Seele Pvt Ltd

Mujhe online registration karwana hia sir kaise kar skte hia

ReplyDeletegstsuvidhacenters.com

GST रजिस्ट्रेशन कैसे कराये इस बारे में पोस्ट में विस्तार से बताया गया है लेकिन उससे पहले पता करे आपको किस प्रकार Tax Payer बनना है इस आर्टिकल में एक Normal Tax Payer(GST) कैसे करे, इस बारे में दिया गया है।

Deleteकरण भाई नमस्कार मैं पहली बार आपके

ReplyDeleteब्लॉगर पर आया हूं आपकी पोस्ट पढ़कर मुझे बहुत खुशी हुई आपने बहुत अच्छे से जानकारी दी है मैं आशा करता हूं आगे आने वाले टाइम में भी ऐसे ही जानकारी देते रहेंगे बहुत अच्छी पोस्ट लगी जानकारी मेरी समझ में पूरी आ गई

भाई बहुत अच्छा लगा पढ़कर आपकी पोस्ट को भाई इसके अलावा आपने और कौन सी पोस्ट डाल रखी है जरा उसकी लिंक मुझे दे दीजिए या अपना यूट्यूब पर चैनल या व्हाट्सएप वाला नंबर दे दीजिए मुझे बहुत खुशी होगी आप बहुत अच्छे इंसान हैं

ReplyDeleteSIR EK QUESTION HAI APNA BUSINESS KA NAME KA PE DALE GST REGISTRATION KE UNDER PLEASE SIR BATAYE & YOUR POST VERY USE FULL

ReplyDeleteBusiness Detail ke under Trade Name dekhenge yahan par aap apne business ka naam de sakte hai jis naam se apka business registered hai.

Delete